- Are all cryptocurrencies the same

- What is the market cap of all cryptocurrencies

- Market cap of all cryptocurrencies

All cryptocurrencies

Losing market perception reduces the demand for a cryptocurrency and drives its value down. If you ever asked yourself, “why is crypto going down?” or wondered why some tokens crash (its value fell to zero or near-zero), a loss of market perception is often to blame https://greenleafsupplements.com/games/dicegames/.

Cryptocurrency prices change rapidly due to factors like investor emotions, market news, and trading volume. Since the market operates 24/7, prices can shift at any time. Limited regulation and speculative trading also add to the unpredictability.

In the U.S., discussions about reversing digital asset regulations have caused market volatility. The potential elimination of the IRS’s crypto broker rule has further fueled uncertainty. These examples demonstrate how regulatory decisions can create ripple effects across the cryptocurrency market.

Cryptocurrencies, especially Bitcoin, have shown a correlation with traditional markets like the S&P 500. These markets are influenced by macroeconomic factors such as inflation rates, GDP growth, and unemployment rates. Therefore, when these factors affect traditional markets, they also impact the cryptocurrency market, leading to a coordinated movement.

Are all cryptocurrencies the same

As your crypto portfolio grows to include various coins and tokens across multiple wallets and exchanges, keeping track of your transactions can become challenging. KoinX simplifies this by automatically syncing your crypto activity, categorising your assets, and generating accurate, country-specific tax reports in just a few clicks. Join KoinX today and take the hassle out of managing your crypto taxes, no matter what type of cryptocurrency you hold.

Cryptocurrencies differ in terms of how their monetary value is established. Bitcoin’s monetary value is almost entirely dependent on supply and demand. Knowing that there is only a limited supply of bitcoins, prices go up or down commensurate with demand. If more people are buying than selling, the price goes up. Prices fall when and as sellers outpace buyers.

Digital currencies do not have physical attributes and are available only in digital form. Transactions involving digital currencies are made using computers or electronic or digital wallets connected to the internet or designated networks. In contrast, physical currencies, such as banknotes and minted coins, are tangible, meaning they have definite physical attributes and characteristics. Transactions involving such currencies are made possible only when their holders have physical possession of these currencies.

You might have a project that utilizes blockchain technology to control the flow of goods. We can imagine a shipping company here. They have developed a blockchain program for logistics management, a program that relies on the creation and transfer of tokens in order to keep track of inventory.

The thing to understand is that some cryptocurrency platforms are not intended to be used as daily monetary systems. As such, you would not expect them to enjoy widespread acceptance among consumers and merchants. These types of cryptocurrencies serve some other purpose.

What is the market cap of all cryptocurrencies

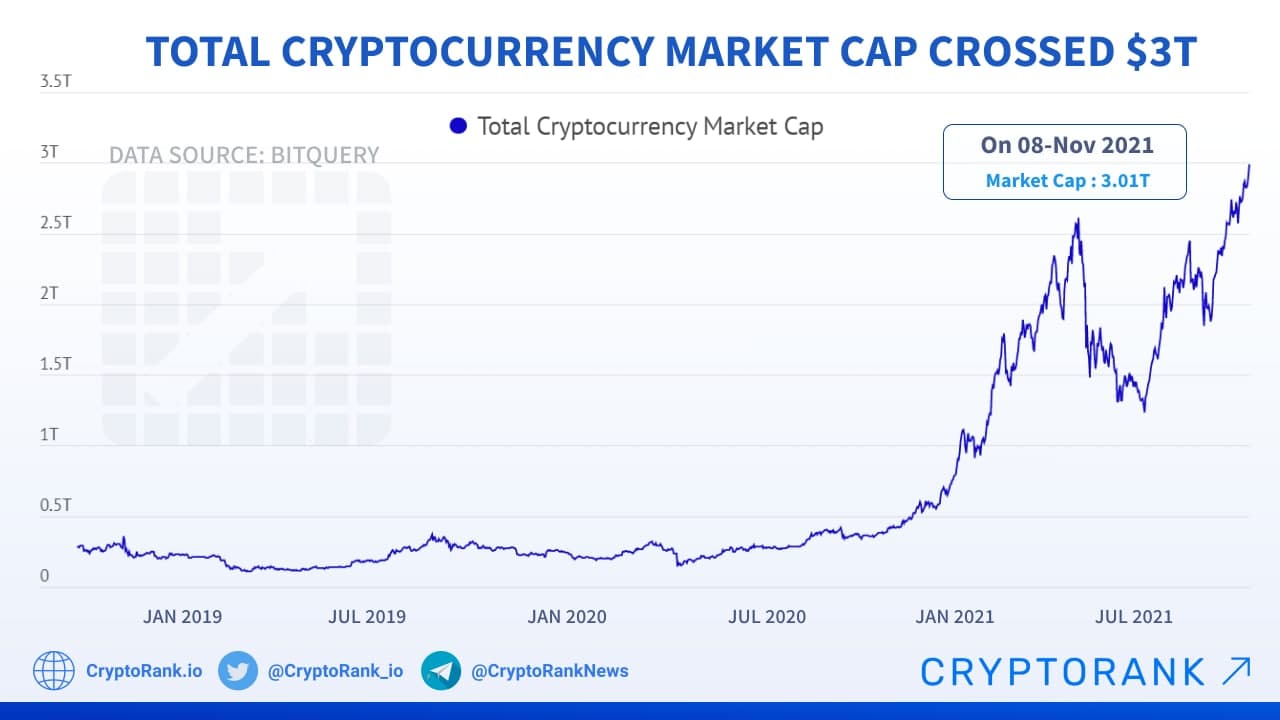

Crypto market capitalization or «crypto market cap» for short is a widely used metric that is commonly used to compare the relative size of different cryptocurrencies. On CoinCodex, market cap is the default metric by which we rank cryptocurrencies on our frontpage. We also track the total cryptocurrency market cap by adding together the market cap of all the cryptocurrencies listed on CoinCodex. The total market cap provides an estimate on whether the cryptocurrency market as a whole is growing or declining.

Bitcoin is the oldest and most established cryptocurrency, and has a market cap that is larger than all of the other cryptocurrencies combined. Bitcoin is also the most widely adopted cryptocurrency, and is accepted by practically all businesses that deal with cryptocurrency.

A coin is a cryptocurrency that is the native asset on its own blockchain. These cryptocurrencies are required to pay for transaction fees and basic operations on the blockchain. BTC (Bitcoin) and ETH (Ethereum) are examples of coins.

Each of our coin data pages has a graph that shows both the current and historic price information for the coin or token. Normally, the graph starts at the launch of the asset, but it is possible to select specific to and from dates to customize the chart to your own needs. These charts and their information are free to visitors of our website. The most experienced and professional traders often choose to use the best crypto API on the market. Our API enables millions of calls to track current prices and to also investigate historic prices and is used by some of the largest crypto exchanges and financial institutions in the world. CoinMarketCap also provides data about the most successful traders for you to monitor. We also provide data about the latest trending cryptos and trending DEX pairs.

Crypto market capitalization or «crypto market cap» for short is a widely used metric that is commonly used to compare the relative size of different cryptocurrencies. On CoinCodex, market cap is the default metric by which we rank cryptocurrencies on our frontpage. We also track the total cryptocurrency market cap by adding together the market cap of all the cryptocurrencies listed on CoinCodex. The total market cap provides an estimate on whether the cryptocurrency market as a whole is growing or declining.

Bitcoin is the oldest and most established cryptocurrency, and has a market cap that is larger than all of the other cryptocurrencies combined. Bitcoin is also the most widely adopted cryptocurrency, and is accepted by practically all businesses that deal with cryptocurrency.

Market cap of all cryptocurrencies

Crypto market cap matters because it is a useful way to compare different cryptocurrencies. If Coin A has a significantly higher market cap than Coin B, this tells us that Coin A is likely adopted more widely by individuals and businesses and valued higher by the market. On the other hand, it could potentially also be an indication that Coin B is undervalued relative to Coin A.

IEO stands for Initial Exchange Offering. IEOs share a lot of similarities with ICOs. They are both largely unregulated token sales, with the main difference being that ICOs are conducted by the projects that are selling the tokens, while IEOs are conducted through cryptocurrency exchanges. Cryptocurrency exchanges have an incentive to screen projects before they conduct a token sale for them, so the quality of IEOs tends to be better on average than the quality of ICOs.

We calculate a cryptocurrency’s market cap by taking the cryptocurrency’s price per unit and multiplying it with the cryptocurrency’s circulating supply. The formula is simple: Market Cap = Price * Circulating Supply. Circulating supply refers to the amount of units of a cryptocurrency that currently exist and can be transacted with.

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

Each of our coin data pages has a graph that shows both the current and historic price information for the coin or token. Normally, the graph starts at the launch of the asset, but it is possible to select specific to and from dates to customize the chart to your own needs. These charts and their information are free to visitors of our website. The most experienced and professional traders often choose to use the best crypto API on the market. Our API enables millions of calls to track current prices and to also investigate historic prices and is used by some of the largest crypto exchanges and financial institutions in the world. CoinMarketCap also provides data about the most successful traders for you to monitor. We also provide data about the latest trending cryptos and trending DEX pairs.

13 августа, 2025

13 августа, 2025  hooligan67

hooligan67

Опубликовано в рубрике

Опубликовано в рубрике